In order to receive the decreased rate, you’ll should pay back an upfront Charge at closing, named a buydown cost. In this particular set up, your setting up desire price might be diminished by 3% for your initial year. The second yr, your price are going to be 2% fewer and only 1% decrease from the 3rd calendar year. Once the third yr, you’ll be shelling out the total interest amount for the rest of one's house loan.

Estimating your score will never hurt your credit score and can help us supply a variety of accessible rates.

The house buyer earns these lessen payments by way of a “buydown cost” which can be paid by an intrigued 3rd party just like a property builder, vendor, or Real estate agent, or by the home customer.

That way, you’ll be capable of make the best selection for you and your family members if you purchase a household. Precisely what is a Property finance loan Buydown?

By cutting down the desire charge inside the First yrs, you are able to gain from decreased monthly payments all through that time period.

Additionally, take into consideration your very long-time period financial targets. Will you be intending to remain in your latest home for an prolonged period, or do you foresee moving inside the near foreseeable future?

This system was created to offer purchasers a little bit respiration room when increased interest costs threaten to derail their dream of homeownership. A 3 share stage variance within your mortgage bank loan will make a substantial influence on your month-to-month payment.

With our in depth understanding and abilities, we’ll assist you navigate the intricacies of charge buydowns, making certain you make knowledgeable decisions that align together with your targets. Don’t wait to Get in touch with us with any inquiries or fears you could have.

The 3-two-1 Buydown Personal loan allows builders to grow their get to and gain a competitive edge in excess of other builders of their industry. In crowded marketplaces, sellers can stand out by offering to pay some or all the buydown fee for a “seller concession.”

Appraise your ease and comfort amount with probable long term rate boosts and assure which you can afford to pay for the home finance loan payments after the buydown period of time expires.

Property finance loan details really are a sort of buydown. Buying details does lessen the fascination price in your loan—Just about every level (which charges one% in get more info the loan amount) takes the speed down by 0.25%. But unlike the buydowns we’re referring to here, points previous for your daily life of your respective home finance loan (Except if you refinance).

Look at how much time you propose to stay in your house and if the Preliminary desire rate reduction justifies the potential price boost Sooner or later.

Never correspond While using the sender. Check out the senders electronic mail deal with not just the identify CMG email messages will often come from cmgfi.com or cmghomeloans.com.

After the momentary buydown period of time ends, the desire amount returns to the first rate, and frequent mortgage loan payments resume.

Tony Danza Then & Now!

Tony Danza Then & Now! Patrick Renna Then & Now!

Patrick Renna Then & Now! Andrew Keegan Then & Now!

Andrew Keegan Then & Now! Barbara Eden Then & Now!

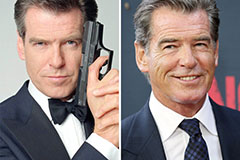

Barbara Eden Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!